4 min read

How To: Deliver An Engineered Experience for Branch Visits

Ashley Incardone : 8/26/21 3:22 PM

74% of consumers visit the branch at least 5 times a year. Yet 60% of consumers DO NOT have a banking relationship with a staff member of their branch (TimeTrade).

This should tell you two things:

- Your branches are still needed, even in this shift to digital and mobile

- Your branches are not serving their purpose as advisory centers, but rather as expensive transaction centers.

So, what’s standing in the way of delivering a branch experience that generates valuable relationships between your clients and your staff?

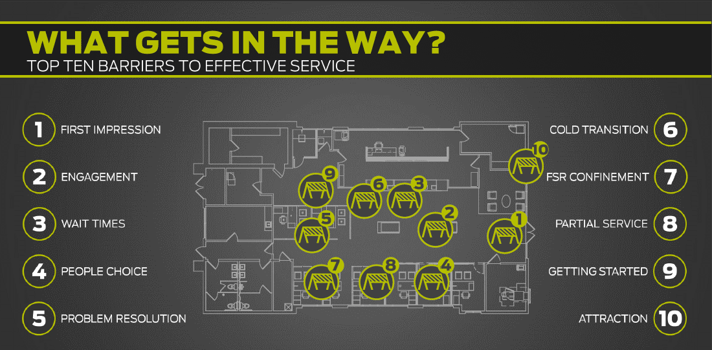

We’ve found that there are several common barriers to effective sales and service found in most typical traditional branches, with the top 5 listed below (and the top 10 listed in the image below that):

- First impressions are often damaged by a boring appearance, outdated technology, and poor customer service.

- Clients get lost in their phones while waiting to be served rather than engaging with marketing materials and exploring the solutions you offer.

- Teller lines with traditional queue ropes and stale lobbies make wait times feel even longer than they are in reality.

- These same teller lines restrict a client's ability to choose what banker they work with and instead forces people to be served by whoever says “next!”

- If a client comes in to do more than just a transaction, it is likely they will have to wait for a banker. And if they have to complete a cash transaction, the banker (who is confined in an office) will likely be sending the client back to the teller. This makes problem resolution a difficult thing with each associate only being able to partially assist.

All of these barriers equate to a terrible client experience.

You may look over this list and think “well a quick branch remodel or some new tech can fix that, right?”, but you’d be wrong.

You can design the coolest, most modern branch and pack it with revolutionary technology, but it doesn’t guarantee a good client experience. The only way to be confident in the experience your branches deliver to clients is to be confident in the people delivering the service: your associates.

In a retail world, especially in banking where your staff set you apart from the rest, your people and the service they provide are your power. If your associates are not comfortable in the branch environment, don’t know how to use the technology, and feel awkward speaking to clients in an advisory manner, there is no hope for a 5-star online rating.

So how do you build a team of power players who not only leave clients feeling satisfied but also blow away your sales and service goals? With comprehensive staff training built to deliver a highly engineered client experience.

3 Top Components to Staff Training for Banks & Credit Unions

1. Convey to your staff the purpose of the branch

When dealing with a company where employees truly believe in the mission, you can feel the difference the moment you walk in the door. When going through a transformation, get your staff involved as active participants. Help them understand and internalize the uniqueness of your branch experience and what it delivers to your clients.

And if you’re making any big changes in your branch or building a new one, start by discussing with your employees what wasn't working with the old process, new steps that are being added to deliver a better experience, and how the new design, equipment, and/or technology will help them benefit clients.

2. Prepare them with talk tracks

Employees need to be able to succinctly communicate the value of your services to clients. While you may think they should be able to develop that skill on their own, equipping your employees with a repeatable way to have conversations will greatly increase the delivery of intended results. The quickest way to do this is to develop a list of key points you want to be highlighted and turn it into a talk track your staff can be proud of and excited to share with clients and the community.

3. Role play with transitions

Plan for the best experience for the client - don't leave it to chance. That means actually role-playing with employees to show them how to interact and transition clients to the elements of the branch. If a client comes in with a request and you've added new technology (self-service for example), act that out so the employee knows exactly how they should respond when the situation comes up.

Moral of the story... Don’t forget about your people. It all comes down to your front line, your people who are tasked with delivering this to your clients.

With the amount of effort that you put into creating your branch experience, go a little further to equip your team with the understanding of how this experience demonstrates your financial institution’s commitment to improving their financial future.

But you don’t have to go at it alone...and unless you’re a professional services trainer, we recommend that you don’t. Let our expert trainers do it for you instead.

Introducing Delivery Defined ™

DBSI makes staff training easy with a program known as Delivery Defined ™ that provides the final link to lasting Branch Transformation by providing your staff with the tools they need to execute your strategic intent.

We work diligently with you to create a program and a set of tools specific to you, train your team and provide ongoing support to ensure your staff gets it now, and continues to deliver it going forward.

We work with you to:

- Identify strategic/operational intent for the new concept branch and key elements

- Define the talk tracks for each key element

- Map transitions from one key element to another

- Identify staffing requirements

- Create a unique playbook specific to your brand and culture

What clients say about Delivery Defined:

- “DBSI made the training a fun and inviting atmosphere. By breaking it down step by step, it challenged our thinking of elements we hadn’t thought about until today.” - EVERGREEN BANK

- “There is more to transformation than just a beautiful space and cool technology. You have to bring the people and process change along with it. DBSI was instrumental in helping our organization identify and create the right process for our people to excel in the new environment.” - MERCANTIL BANK

- “Our associates have mentioned multiple times the confidence they felt after the Delivery Defined program. They’ve been able to serve our members from start to finish focusing on better service and upselling and spend less time trying to remember a process.” - VANTAGE WEST CREDIT UNION

You can learn more about the Delivery Defined program by clicking the 1-sheet below: