Ready to explore?

Come see the latest innovations, strategies, designs and technologies through hands-on experience.

Let's Talk

If you’re ready to get started with your next project and think DBSI may be a good partner, we should chat.

Careers

We are always looking to add talented, forward-thinking innovators to our team. If that sounds like you, you should apply for a role with us.

Sign Up For Our Newsletter

We are always looking to add talented, forward-thinking innovators to our team. If that sounds like you, you should apply for a role with us.

2 min read

Is Your Content Strategy Pushing You up a Creek Without a Paddle?

Alisa Semyekhina

:

5/19/22 7:30 AM

Alisa Semyekhina

:

5/19/22 7:30 AM

Content is king, but quantity over quality is not the answer. If a credit union marketer is allocating resources to a strategy that seems to align with their goal, but growth is stagnant — then they might be up a creek. Maybe they say, “it must be the associates,” or “it’s the competitors," or a dozen other excuses. I think there is a bigger culprit to stagnant growth. I’m here to challenge the strategy of what is being promoted and where.

Too many good credit unions are clearly defining goals and priorities only to have a disconnected marketing strategy around the member journey. They find themselves drowning in content and promotions with no idea what to do next and no life raft in sight.

The most successful credit unions have managed to align their yearly goals with their marketing strategy AND the member journey. The member journey is your map and without it, well, you’re up the wrong creek with a burnt-out paddle.

A New Understanding of the Member Journey

The member journey looks completely different than it did 5 years ago. Partially due to the pandemic, but also the changes in technology in multiple industries. QR codes are having a comeback better than the Cubs winning the world series after a 108-year drought. Online grocery shopping (think Instacart) seemed like an unnecessary luxury service until the pandemic. A new level of convenience was born out of necessity and consumers are not willing to give it up.

Credit union marketers have to take a step back and realize that now, most first impressions of their brand aren’t at the branch. And their strategy should account for that experience.

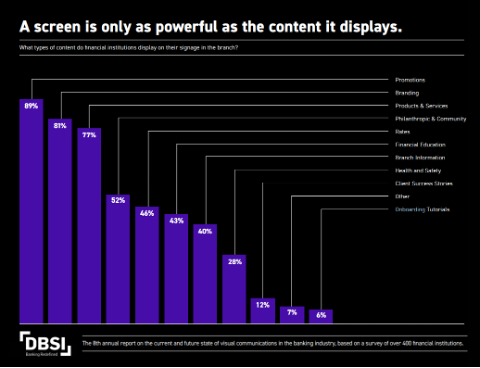

Rates Vs. Anything Else

Content promoting “rates” was ranked in the top 5 promotions running in the branch. I think this is a colossal mistake because rates are easily accessible on the user’s personal mobile device. In fact, I would argue personal experience is much more valuable for the member. Think about it, when the member needs updated information about rates they aren’t in the branch; they are out shopping or considering making a purchase. That in-branch messaging real estate is too valuable to waste on something like that!

Instead, use your in-branch messaging as your (most cost-effective) front-line sales associate. Highlight success stories of other members benefiting from all of your business lines. Now, they think about your brand with the desired image they have of themselves buying a new car, house, etc.

Onboarding to Mobile

Most credit unions say they are looking to move more members to mobile channels to decrease their cost-per-transaction and provide a better member experience. But when it comes to using tools to encourage onboarding to mobile, many are missing the mark.

Only 6% of digital signage content is “onboarding to mobile banking” tutorials even though that has been a top priority for so many credit unions! (DBSI’s Annual Digital Signage Benchmark 2022)

It is a well-known fact that onboarding more clients to mobile cuts costs and increases the member’s loyalty. So, why is it often forgotten in the in-branch content strategy? I believe the disconnect is in onboarding the onboarders. Training associates, the people on the floor, in doing the actual onboarding with your members is where so many CUs fall flat. Talking to members about mobile transaction options a part of the associate’s process. It must be woven into every member interaction until the onboarding campaign reaches the goal.

It is a well-known fact that onboarding more clients to mobile cuts costs and increases the member’s loyalty. So, why is it often forgotten in the in-branch content strategy? I believe the disconnect is in onboarding the onboarders. Training associates, the people on the floor, in doing the actual onboarding with your members is where so many CUs fall flat. Talking to members about mobile transaction options a part of the associate’s process. It must be woven into every member interaction until the onboarding campaign reaches the goal.

Start heading in the right direction

Seasoned marketers know that finding comfort and rhythm in marketing usually means it’s time to look up and reevaluate your strategy. With the new era of consumers comes a new era of marketing strategy. 96% of financial institutions are maintaining or increasing their budget for content creation in 2022. (DBSI’s Annual Digital Signage Benchmark 2022)

For the past several years respondents have said that digital signage has a positive impact on sales. The credit unions that have a positive impact on sales have a deep understanding of their member experience journey and strategy that aligns. Make sure you set your path before you start your journey.

Download the full report

Originally published by CU Insight, March 2