2 min read

A Universal Banker Success Story: The Final Piece to Transformation

Janice Bourbon

:

2/7/23 4:11 PM

Janice Bourbon

:

2/7/23 4:11 PM

In today’s technology-driven world, financial institutions are still failing to meet client expectations and educate their clients on the full menu of services and products they offer. For proof: the average consumer has 16 banking products, but on average only 2.5 with their primary institution (2018 DBSI Digital Signage Agency Report). Why is this the case?

The client experience in most financial institutions is stagnant and is still providing the same mundane experience that older generations had. Front-line staff is failing to provide clients with valuable product education and financial guidance, largely due to being confined to single roles and branch locations: tellers who work behind teller lines and bankers who work in office spaces.

There’s one problem with this service model. There has been a shift in consumer expectations and they demand higher levels of service.

70% of consumers consider their relationship with their bank to be transactional in nature, rather than relationship. (Evergage)

Today’s clients do not want to bank with a provider that has stale branches, outdated technology, and lackluster service; they want an elevated retail-friendly experience with branch technology that allows them to do banking when, where, and how they want.

Essentially, they want to choose their journey from the second they step in the branch, just like they can in Buckeye State Bank.

|

.png?width=532&height=399&name=Buckeye%20Blog%20Images%20(3).png)

|

Their branch was completely transformed by our team with elevated design details, new technology, and a more inviting look and feel — but their staff lacked the knowledge of how to fully optimize their branch space.

This is where our DBSI team of professional experts came in to provide the last piece of the puzzle, our Delivery Defined Program, a proven hands-on training that acts as the final link for a lasting transformation.

“The ultimate goal of our Delivery Defined program is to give the client an enhanced retail experience,” said Janice Bourbon, DBSI Experience Engineer. “The branch should feel like an Apple store, where you walk into an open floorplan, and the service is more advisory rather than transactional.”

Working with the Buckeye State Bank team, our DBSI Professional Services team provided the staff training on the new technology and open concept floorplan to best optimize the branch.

- Their Universal Bankers utilize inviting and educational digital signage to walk clients through ongoing promotions, products, and even their local community events.

- User-Friendly Self-Service Tablets allow branch visitors to self-serve, freeing up Universal Bankers to address more complex needs.

- Key interior design details, such as Buckeye State Bank's open floorplan, allow for advisory-level conversations to take place from anywhere within the branch — not just behind teller lines.

- A welcoming Kid-Zone and Beverage Bar provides clients with a warm, comforting environment in which they feel right at home.

|

|

|

Buckeye State Bank's new space exceeded expectations. After completing our Delivery Defined training, their staff now felt educated, confident, and ready to fulfill any service need coming their way.

Better yet, their staff now knew how to properly serve clients from anywhere within their branch, promote their current offerings, and use Service Spots for more efficient service.

It’s no longer enough to just build a building, financial institutions must redefine how they deliver retail banking through this transformation process.

It’s successfully connecting all the elements within a branch — its leveraging technology to create convenience, providing product education on digital signage, and providing those personalized interactions that leave a lasting impact.

Buckeye State Bank's modernized retail space allows their clients to choose their journey from the moment they walk in the branch.

The Comfort Zone is intended to host clients and make them feel welcomed and relaxed as they temporarily wait for the next available Universal Banker.

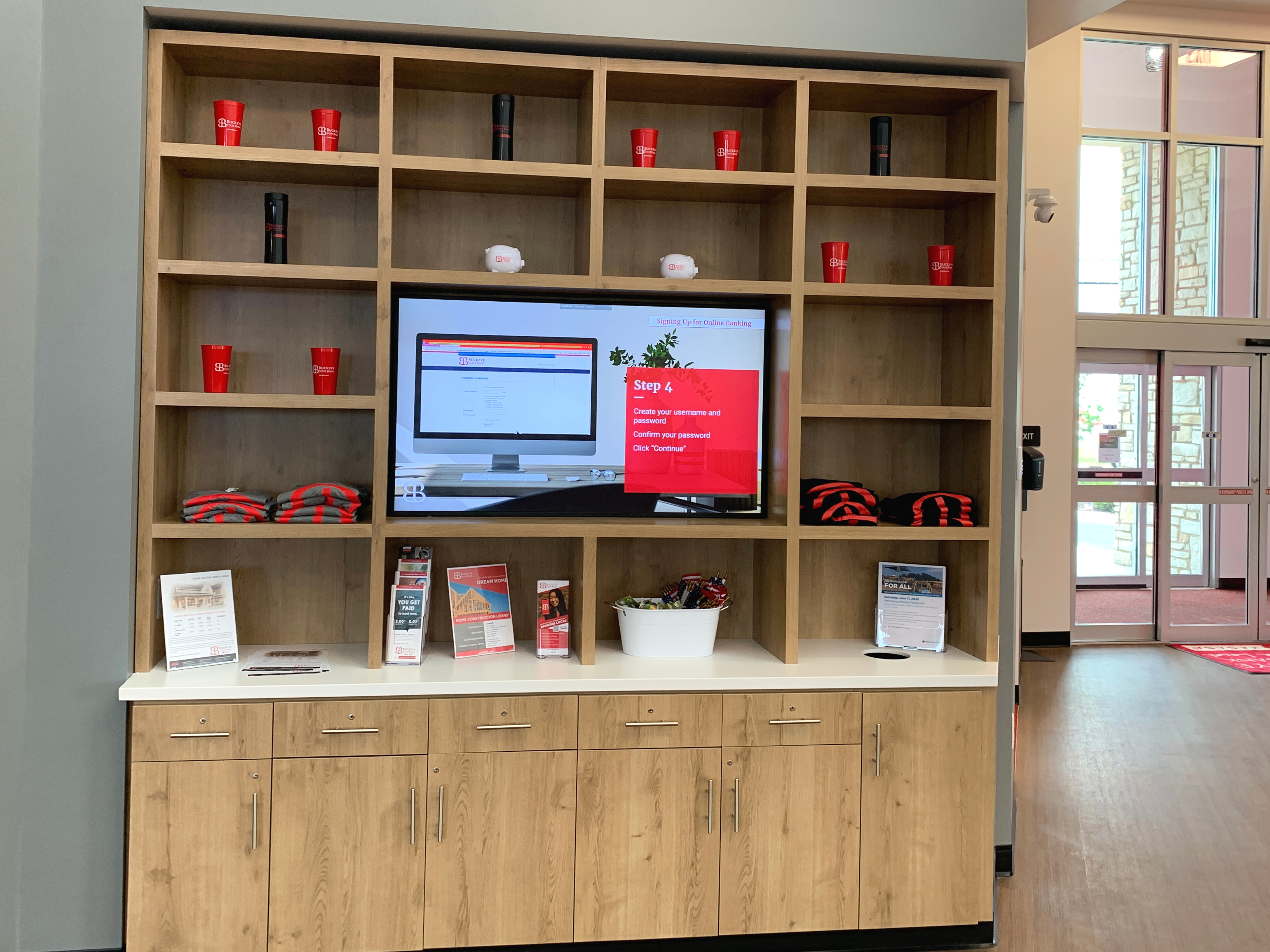

From digital signage to branded t-shirts, this modernized wall display provides clients with many ways to engage with the brand and proudly represent Buckeye State Bank.

In Buckeye State Bank's Perrysburg branch, tablets are programmed with games to entertain children in the Kid Zone.

The branch's digital signage features dedicated content where clients can learn about Buckeye State Bank, current offerings, or receive educational assistance such as how to sign up for online banking.

Together, let's bring the vision for your future to life!

Through DBSI’s carefully curated professional service programs, we can help shift your staff’s culture, processes, job descriptions, and so much more.