4 min read

Bank Equipment Repair and Maintenance: Your Service Team vs DBSI

.png) Amanda Farmer

:

4/5/23 8:00 AM

Amanda Farmer

:

4/5/23 8:00 AM

Choosing the right service provider for your banking equipment comes down to five key rating categories you should know about and use!

In the banking industry, it can be a challenge to find a qualified service provider with adequate experience and good-enough customer ratings to do the job right – which means a lot of banking machines like ATMs, ITMs, and Teller Cash Recyclers (TCRs) are often left underserviced and underperforming.

What a bummer, right?

At DBSI, our service technicians always strive to provide the best possible customer service, and we have the data to back it up. We can proudly say that our First Time Resolution rate is at 94%, and our Retention on Service rate is at 97%.

That said, if you feel like you’re experiencing downtime in your branch network, just know this: You don’t have to sit there knocking on the cash recycler for the next week hoping the screen resets faster (save that for the M & M’s stuck in the vending machine). Instead of waiting, you can find faster and better ways to get your banking equipment repaired just by knowing what to look for in a provider.

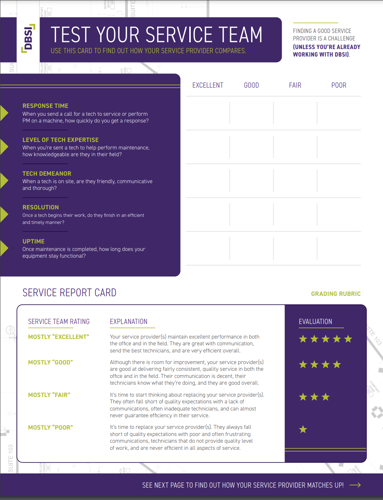

To put your current service team to the test, DBSI created five rating categories to help you determine service team quality, and we’ve assembled these categories inside a handy little report card you can fill out to grade your technicians!

Ready to get started?

Download your free service team report card here and learn more about five service rating categories below:

Quick response time

When a machine breaks down or when maintenance is due, having a service technician respond to your inquiry in a timely manner is critical to both your schedule and the schedule of your frontline staff.

How fast do your technicians respond to calls for assistance?

A great provider will respond quickly and return your call, text, or email within 45 minutes, just like DBSI does. A great provider will also be on-site within four hours of your initial contact to fix equipment or perform maintenance. If you're not experiencing these time frames, understand that there are significant costs involved in your equipment being offline.

Our DBSI Service Team is well-known for its fast response time. And we aren’t just fast… we’re accurate too; that’s why we have a First-Time Resolution rate of 94% amongst the banks and credit unions we serve. What this means is that for all the assistance inquiries processed by our DBSI Service Team, 94% of them are resolved at the first point of contact–either through emails, phone calls, or a visit from our service technicians.

A High Level of Technical Expertise

Knowledge of industry-specific machines and equipment is critical in the banking industry, especially when every hour of downtime affects a financial institution’s profitability and reputation. In this respect, make sure you’re always counting on a dedicated team that focuses solely on banking equipment. By doing so, you are more likely to have trade masters arriving to do installations and repairs instead of apprentices.

Curious what we can handle at DBSI? We’ve got dedicated, highly-trained service and installation teams who are long-time experts with the following:

- TCRs

- Self-Service machines including ATMs, ITMs, and core-integrated kiosks

- Vaults and safes

- Drive-ups

- Alarms, CCTVs, and lock work

- And more!

With 25 years in the industry, DBSI was founded on banking equipment. As seasoned experts in this space for over two decades, we provide the clients we serve with agnostic brand expertise, hassle-free installs, and dedicated customer service.

And when it comes to the technology you use in your branch, we don’t just service it, we sell it too! With a vendor-agnostic approach, our partners include ARCA, ATEC LTA, CIMA, Hyosung, NCR, and more. If your preferred manufacturer isn’t mentioned here, just ask us! We can likely help you with any service request, as well as find the banking equipment that is best for you.

From arranging your equipment, to the install and service, our service technicians handle all the logistics, leaving you at ease.

A longtime client of ours, Altura Credit Union, appreciates our attentive service.

“We could not have asked for a better install team than DBSI! They show up on time and they really know their stuff. We have been very pleased with the entire process start to finish. I fully recommend DBSI.”

Good Tech Demeanor

When you work hard to build up your branch network’s brand image, the last thing you want is a contractor coming in and distracting your clients or making them feel uncomfortable. And that’s why a service team that’s friendly, communicative, and thorough deserves a high rating on your Service Team Report Card.

Our technicians at DBSI take great pride in maintaining a professional appearance and always complete tasks with friendly dispositions and positive attitudes. They communicate consistently on job progress at all times and when the work is complete, they make sure the service location is mess-free and functional.

Prompt Resolution for Service Needs

From the first point of contact to the final step of an installation or repair, efficiency and timely completion of work says a lot about the overall quality of the provider you hire. And so does the manner in which they go about their work (especially during business hours). Can your staff and clients meet without disruption? Is your branch staff able to move freely throughout the branch and complete necessary tasks? If you’ve been with the same provider for many years, it’s likely that you’re rating them highly in this category.

Speaking of the same provider, our service technicians have great relationships with customers, and it shows because our Retention of Service rate is at 97%! In fact, some banks and credit unions have been calling on us at DBSI for 25 years now.

A Focus on Uptime

A strong commitment to ensuring that all of your bank or credit union’s equipment and machines stay functional is a sign of an excellent service provider. In our world, that means striving for a high first-time fix rate while also ensuring optimal equipment longevity.

Does your service provider encourage a routine maintenance schedule?

If not, they should be. Our DBSI Service Team recommends that your financial institution’s cash recyclers receive preventative maintenance at least twice a year, and your banking equipment at least once per year.

When it comes to uptime, OnPoint Community Credit Union is a big fan of our attentiveness and advising, noting that “DBSI delivers on what they commit to. Keeping our recyclers up and running is just as important to DBSI as it is to us. Plus, we trust them because we know their recommendations will be right.”