4 min read

Get a Head Start on 2024 Strategic Planning with This Top Intel from Banking Leaders

Jared Jones

:

3/22/23 1:38 PM

Jared Jones

:

3/22/23 1:38 PM

Peter F. Drucker, one of the 20th century’s most influential management consultants, once said, “Wherever you see a successful business, someone made a courageous decision.”

Considering today’s digital technology and the rapid evolution of how clients are choosing to bank, it’s no surprise then that traditional financial institutions (FIs) are putting extensive effort into identifying which initiatives must go into their annual budgets. And as much as it can be an intimidating process, even for the bravest of financial executives, it doesn’t have to be done alone!

DBSI provides thought leadership, technology tools, and design-build services to banks and credit unions of all asset sizes, transforming branches and headquarters with smart solutions that fit every budget. With the future in mind, DBSI surveyed 150 credit union and bank leaders on their strategic planning processes to provide you with some useful insights when planning for the year ahead.

This blog will give you a few takeaways to help plan for 2024 — with plenty of time to adjust!

Here are some things to think about:

Bank or Credit Union Strategic Planning: Do it Early, Do it Often

The famous adage “Fail to plan, plan to fail” is true for most things, and fortunately, at least 50% of survey respondents said they put together a strategic plan every year to help keep their service models “fresh and future-proof.” It takes about three months to put together a plan, on average, with FIs in larger asset classes taking the most time. Among all respondents, approximately one-third revise their strategic plans quarterly.

While there’s no magic formula for building or revising a strategic plan, yours should be tailored to your bank or credit union’s culture and, at a minimum, include the following:

- A review of your existing plan and its revisions

- A SWOT analysis

- An assessment of your operating environment: economy, markets, legislation, and demographics

- Forecasting models

- A contingency plan

Our FI is making major upgrades in the coming years. Where can we get help with our strategic plan?

Check out the Ideation Center at DBSI. It’s a place where you can explore the latest ideas, strategies, trends, and technologies in banking with experts who put their time and energy into transforming banks and credit unions (for free).

Make Service Options #1 at Branch Locations

Necessity might be the mother of invention but then there’s convenience. The rise of neo banks since the COVID-19 pandemic is a prime example of how quickly consumers are accepting digital services to get their everyday banking done. In fact, according to an eMarketer study, the US has one of the highest numbers of digital-only bank account holders in the world—29.8 million at the end of 2021; that number is expected to rise to 47.8 million by 2024.

Despite the popularity of online-only FIs, they have a few big drawbacks including limited services and lack of personal attention. Plus, they’re often not fully chartered. These aspects alone are the perfect opportunity for banks and credit unions to implement digital technology services and make client transactions easier, more convenient, and more entertaining in the future.

According to DBSI’s report, at least 45% of branches surveyed do plan to increase their convenience and service options in 2023, so they’re staying consistent with client demand. And that’s a good thing because 62% of consumers say they still want their FIs to have a physical presence.

What types of banking technologies are FIs adding?

DBSI’s report gives percentage totals of nine technology solutions that banks and credit unions plan to add or improve on in 2023, with the top three being Interactive Teller Machines (ITMs), video banking solutions, and marketing automation platforms, respectively. Of these solutions, banks of higher asset sizes plan to spend more on ITM technology, likely because of the impressive ROI. In fact, a survey from DBSI’s technology partner CFM noted that 30% of FIs using ITMs saw increases in sales and 43% of FIs using ITMs realized a decrease in FTE count.

Here are a few other technology bits you might find interesting:

- 20% of FIs are planning to add new core management systems to their operations in 2023.

- 22% of FIs are busy buying or using neo-banks to keep up with the times.

Whatever banking technology solutions your FI is planning on implementing in the future, always create a realistic budget and make sure you’re partnering with a reputable firm able to assist you with implementation and ongoing service. For ideas on how to build a realistic branch transformation budget, consider utilizing the steps detailed here.

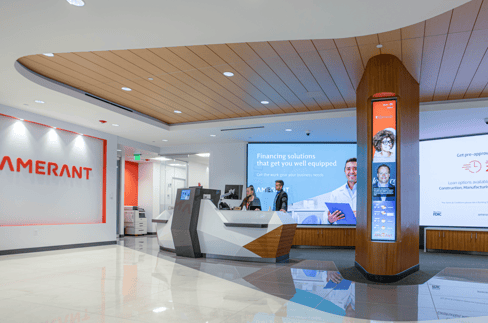

Amerant Bank's flagship branch in Coral Gables. FL. See Case Study. |

|

A Micro Branch is Another Way to Grow Your Banking Network

Big things come in small packages. That being said, expansion of your branch network doesn’t have to mean millions of dollars or multiple years of construction in a pricey real estate locale. A micro branch, typically ranging in size from 150 to 1,500 square feet, is another way to put the power of a large branch in a small and convenient location—without the large price tag. Additionally, the timeline to plan, design, and build a micro branch is 6 to 12 months, on average.

DBSI’s report found that a number of credit unions are planning to add micro branches to their networks in the coming year, yet, they aren’t planning any larger expansion projects. Also, of the credit unions adding micro branches, 30% are coming from asset sizes of less than $100 million and another 30% from asset sizes of $500-999 million.

What kind of services can our FI offer from a micro branch location?

A micro branch, with the help of tech tools like cash recyclers, ATMs, ITMs, and digital signage can provide all the services of bigger branch locations, with less staffing required. And it’s feasible for a micro branch to be run by one or two staff members, particularly if they are trained as Universal Associates.

BCU's Micro Branch in Eden Prairie, MN. Read more in Case Study. |

|

DBSI has helped hundreds of FIs add micro branches to their networks in recent years, and more are on the books for this year. If all of this has your interest piqued, read more about why micro branches make a great investment here.

Your FI’s growth and profitability rely on effective strategic planning, and by looking at the objectives of others in your industry, you can more easily identify what steps you can take to stay competitive. To find out how DBSI can help you with your network’s next big plans, get in touch with DBSI today.