You've mastered the steps to building your transformation budget. No doubt — it’s complicated. Now, you need to tackle two critical pieces of the process:

- Scenario Planning

- Packaging the Budget for the Board

Scenario Planning

With scenario planning, you consider potential events that could occur outside your control and create contingency plans. It’s a strategy that helps remove some of the uncertainty from your budget while providing the flexibility to take advantage of unforeseen opportunities.

Scenario planning arms you with the knowledge to determine what decisions to make, no matter what might occur. Your KPIs are established and on a regular basis, and you refresh scenarios and update assumptions based on what is happening.

Basically, you’re prepared for the unexpected and are armed with a competitive edge because you can react quickly and decisively.

How to incorporate scenario planning into budget planning:

- Identify scenarios that will most impact your if they deviate from your budget.

- Formulate a list of key business drivers that can affect your business the most.

- Define a range of scenarios that can lead you to the right decision while answering questions you may not think to ask until it’s too late.

- Keep a close eye on key drivers. If they start to veer away from your projections, the actions determined as part of your scenario planning can be used to keep the business on track.

From McKinsey, here are the dos and don’ts of scenario planning:

- Fight the urge to make assumptions. Review all trends likely to affect your company’s business, especially interconnections between issues and markets. Don’t rely on readily accessible information or evaluate trends only within a single geography or industry context.

- Beware giving too much weight to unlikely events. Fight the urge to base decisions on what you already know. Don’t focus on numerical precision early in the process.

- Don’t assume that the future will look like the past. Base scenarios on critical uncertainties, engage top executives. Don’t outsource the creation of scenarios or delegate the work to junior team members.

- Combat overconfidence and excessive optimism. Assess the impact of all scenarios and develop strategic alternatives for all of them. Don’t plan only for the scenario deemed most likely.

- Encourage free and open debate. Use systems, processes, and capabilities that sustain scenario-based thinking to install its discipline. Don’t use scenario planning as a one-off exercise or ignore social dynamics such as groupthink.

Why does scenario planning matter in our budget planning for a branch or HQ transformation? As the most obvious example: the pandemic.

FIs that had performed scenario planning were prepared technology-wise. Employees could continue serving members while working from home using digital platforms.

Longer-term scenario planning included contingencies for what to do with unused space if fewer employees are permanently in the office, for example, leasing it out or offering it as community event space.

Packaging the Budget for the Board

With your team, you've already created the right strategy for your transformation by outlining why you need to take action, what you will do, where to apply it, and by when in an Executive Summary. Then, based on that agreed-upon plan, you created an accurate budget based on like projects, industry averages, and your research (bonus points if it's before your deadline!).

But there's one more (big) step you need to take before you can start executing your (well-planned) Branch Transformation strategy: packaging your budget in the right way to get Board approval!

Here's what often happens:

You've done your Branch Transformation homework. You know the data and research, have a logical plan of attack to address the board's requests, and feel confident in the substance and value of your presentation.

Around three minutes into your presentation, you start getting peppered with questions like,

"Have you considered this as well? What is the cost? Which other options have you evaluated? What impact does this have to the overall experience?"

But you can avoid this budget presentation hijack with a different approach. It’s all about how you format your approval request.

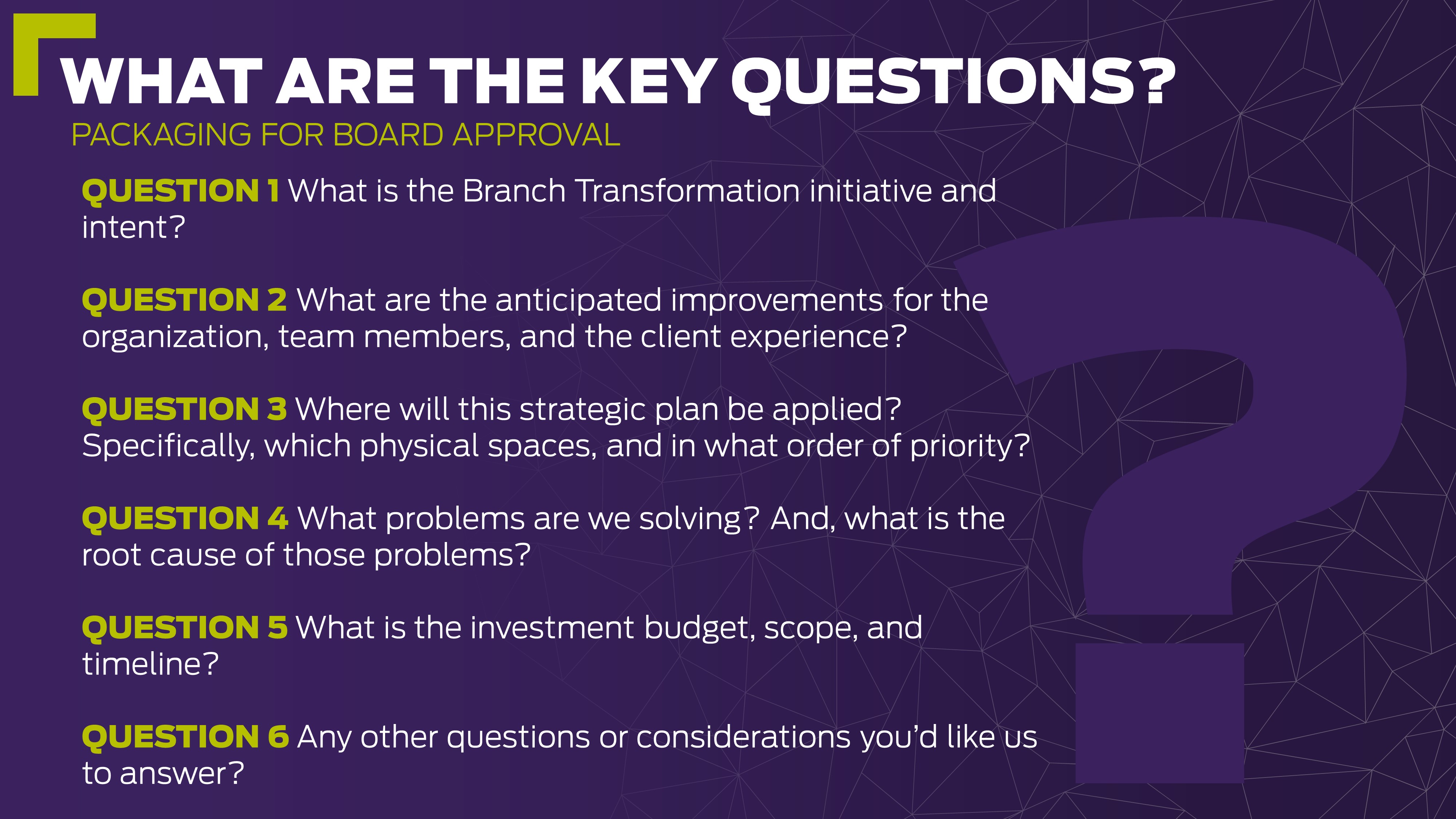

Here's a different approach: begin your presentation by packaging your budget in the format of:

"We've packaged this in the context of the questions we believe you'd want answers to."

Then, state those questions. You will quickly see if there are others.

Here's how this format can help you win:

Here's how this format can help you win:

- By identifying these key questions, you've established an agenda that delivers to the answers your board needs to grant approval and clearly outlines the information you'll be covering within your presentation.

- Now that you've surfaced these questions and asked for others, you've taken the sporadic questions off the table.

- Without sporadic questions and interruptions, you can maintain control of the conversation.

- And, of course, you've packaged the right question with the right strategic intent and budget data for a proper approval request!

Once you get board approval, there's only one thing left to do: execute your transformation strategy!

Want some help packaging this to your board? Our team has helped create these presentations and even gone on site for board presentations many times. Pull from our expertise in navigating these conversations and our knowledge base to answer some unforeseen questions around your project.

We're only a few days away from September, but we have a way to shorten the entire process and drive your initiatives more quickly – and it all starts at a place we call the Ideation Center.

You're invited to join DBSI in Chandler, AZ to spend the day with us where more than 500 financial institutions have started their transformation efforts.

By visiting the Ideation Center, you will:

- Learn the top 10 retail banking barriers to sales and service

- Engage with over 20 retail components, designs and technologies for a hands-on transformation experience

- Discover the latest trends in retail (and how they can work for you!)

Even better, there's no fee to come – all you need to do is get here!

Click the button to learn more about the unrivaled, interactive experience you can expect from a day at the Ideation Center (plus some of our unexpected elements, like our Batpole and golf simulator!)